Electric cars sales boom in November but 'big question marks' over how long it can last, says expert

Signs that private buyers are being turned off

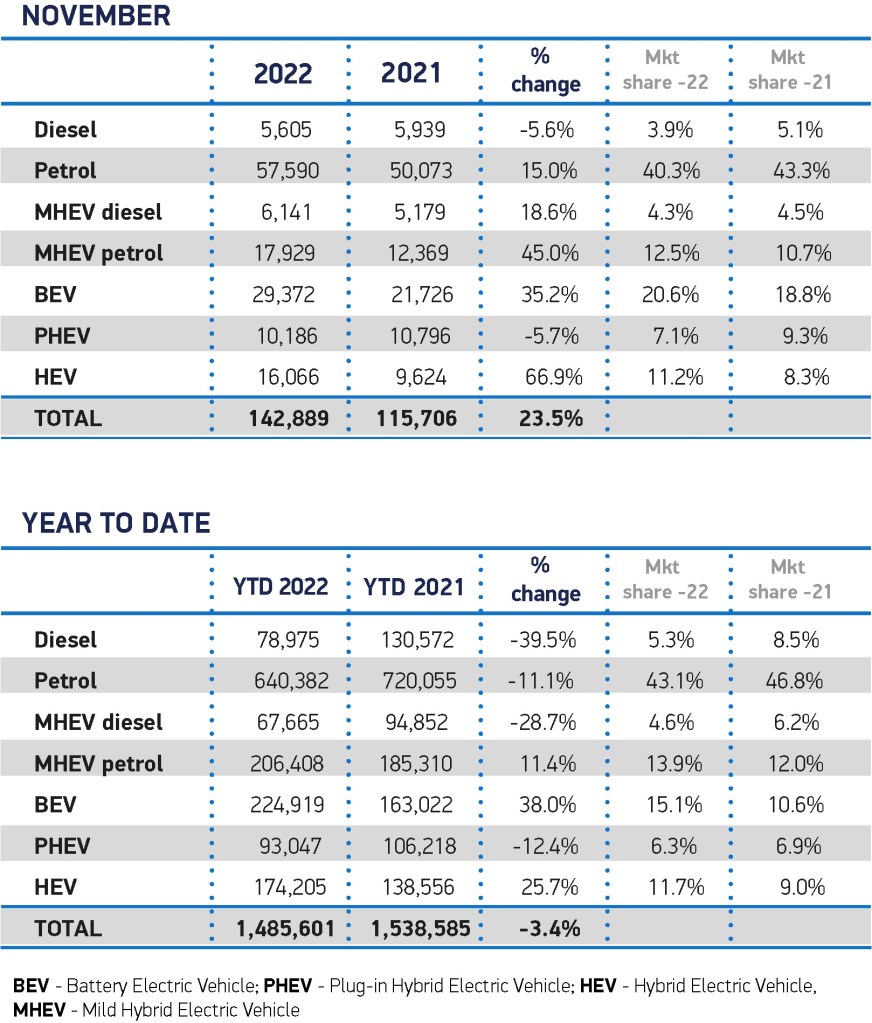

Electric vehicles accounted for 20.6% of new car sales in November — up 35.2% on November 2021 — making battery power the second most popular choice for buyers after pure-petrol models. But one expert believes the surge in EV popularity may not last.

Monthly data from the Society of Motor Manufacturers and Traders (SMMT) shows that out of the 142,889 new cars registered in November, 29,372 of them were pure-electric (also known as battery-electric, or BEV).

Of the 1,485,601 cars sold for the year to date until the end of November, 224,919 were BEVs, giving electric vehicles a 15.1% year-to-date market share. The figure for the whole of 2021 was 11.6% share, which in turn was an increase from 6.6% in 2020, highlighting how their popularity have grown in recent years, as many new models have been launched.

Though pure-petrol car sales were up in November compared with the same month in 2021, and with a 43.1% market share petrol models remain dominant, over the first 11 months of 2022 sales have fallen by 11.1% year-on-year.

Cars powered only by diesel have seen a more dramatic fall from favour, with a 39.5% drop in sales over the past 11 months. Diesel now holds just 5.3% of the market.

What is a mild-hybrid car? | What is a plug-in hybrid vehicle?

It has also been a poor year so far for mild-hybrid diesel vehicles and plug-in hybrids, sales of which have fallen by 28.7% and 12.4%, respectively.

It has been a somewhat better 2022 for mild-hybrid petrol models, though, sales of which have grown by 11.4%, with sales of full-hybrid vehicles (cars such as the Toyota Prius that cannot be plugged in and are capable of running for only very short distances on battery power alone) up by a substantial 25.7%. For that same period, sales of battery-electric vehicles have grown by 38%.

A word of caution, however, was sounded by Ian Plummer, commercial director of Auto Trader who suggested that even though November’s registration figures for electric vehicles were strong, their exponential growth may be trailing off and that the bumper month of November may simply be as a result of supply chains unknotting themselves.

“Even though sales of electric cars have jumped more than a third in the past year, there are big question marks over how long this will last.

“The strong November SMMT figures reflect much earlier demand for EVs that are only now being delivered due to supply problems such as semiconductor shortages or Covid lockdowns in Asia, which are now gradually easing.”

The cost-of-living crisis and high electricity prices are now turning people away from EVs, he claimed.

“Battery EVs accounted for just 19% of our retailers’ sales leads in November compared with more than a quarter in June.

“While EVs remain considerably more expensive to purchase than their petrol or diesel equivalents, recent commentary suggesting that they’re now more expensive to run is as misleading as it is damaging to the take-up of EVs.

“Auto Trader data analysis of a wide mix of vehicles shows an average EV saving of circa £125 per 1,000 miles driven, which is actually up on the circa £100 saving seen in 2020.”

Motor industry bounceback

While the biggest news from the November sales figures is of the strong market share for electric vehicles, noteworthy too are the overall numbers.

Total sales of private vehicles in November actually only increased by 2.7% compared to November 2021 with the bulk of sales for the month being driven by fleet and business sales (up 45.4% and 112.2%, respectively).

The 142,889 new cars sold in the UK in November represent a 23.5% increase on November 2021, and while sales for the year to date are still 3.4% down on the same period in 2021, the fourth successive month of sales growth suggests that the car industry may finally be on the road to recovery following the depths of the Covid pandemic and the global semiconductor shortage.

Still, overall sales are still some 8.8% down on 2019’s pre-pandemic levels, with the relatively small increase in private car sales possibly attributable to the impact of the cost-of-living crisis on household budgets.

The SMMT says that although it expects further recovery of the new car market in 2023, ongoing challenges such as supply chain issues and chilly economic headwinds mean that sales next year may still lag behind those of 2019.

“Recovery for Britain’s new car market is back within our grasp, energised by electrified vehicles and the sector’s resilience in the face of supply and economic challenges,” said the SMMT’s chief executive, Mike Hawes, commenting on the figures.

“As the sector looks to ensure that growth is sustainable for the long term, urgent measures are required – not least a fair approach to driving EV adoption that recognises these vehicles remain more expensive, and measures to compel investment in a charging network that is built ahead of need.

“By doing so we can encourage consumer appetite across the country and accelerate the UK’s journey to net zero.”

Contributing significantly to the boost to EV sales in November was the arrival of a shipment of new cars from Tesla that was enough to boost the company’s Model Y to second place in the sales charts for the month and to ninth place in the year-to-date sales.

Best-selling cars 2022: What are the UK’s top 10 most popular models?

At this stage, Tesla looks unlikely to once again pull off the same coup as last year which, thanks to the arrival of a boat-load of new cars late in the year, saw the firm’s Model 3 saloon named as the UK’s second best-selling car for 2021.

First place in 2021 went to the Vauxhall Corsa and, at present, that model also looks likely to be usurped as it lags around 4,500 units behind the Nissan Qashqai heading into December. A strong surge in sales for the Ford Puma could even see the Corsa beaten into third place, though for now, the supermini appears to be holding firm.

Related articles

- After reading about sales of new electric cars on the rise, you might want to check out our review of the MG4

- Here are all the car makers’ electric car plans

- And have you been wondering if now is the time to buy an electric car? Here’s what we think.

Latest articles

- Omoda 5 prototype review: Bargain family SUV is solid first effort for new Chinese brand

- Dacia Duster 2024 review: Rugged, affordable SUV modernised with electrification and quite the glow up

- Audi A3 Sportback 2024 review: Softly, softly, catchy premium hatchback buyer

- New electric-only Mini Aceman fills gap between Mini Cooper hatch and Countryman SUV

- Tesla driver arrested on homicide charges after killing motorcyclist while using Autopilot

- Porsche Macan 2024 review: Sporty compact SUV goes electric, but is it still the class leader for handling?

- F1 2024 calendar and race reports: What time the next grand prix starts and what happened in the previous rounds

- Aston Martin DBX SUV gets the interior — and touchscreen — it always deserved

- Nissan unveils bold look for updated Qashqai, still made in UK