Used Tesla values plummet: are Elon Musk’s Twitter antics to blame?

Let that sink in

Values of used Tesla models are falling fast, with some models losing nearly a quarter of their value over the 12 months following registration. Analysts believe several market forces are factors in the rapid depreciation, though recent comments from owners in America suggest CEO Elon Musk himself could be a factor.

According to a report in Car Dealer Magazine, the Tesla Model 3 was the worst-performing used electric car losing some 23% of its value (or £9,900) last year alone.

That compares to an average drop over the last 12 months for a one-year-old used car with 10,000 miles of just 2.2% — according to statistics from the used car value experts at Cap HPI.

Tesla’s Model S saloon was also affected, with one-year-old used models losing 22% of their value last year while the company’s Model X SUV depreciated 13.4% in 2022.

In the last three months alone, the Model 3 has fallen by 15% in value, with the Model S losing 8.9% and Model X 4%.

Electric car values have not remained as robust as their petrol and diesel counterparts’ in recent months. The value of used cars remain notably strong in light of the shortage of new cars caused by, among other factors, the global semiconductor shortage that has seriously hampered the supply of market-ready vehicles.

Other used electric cars to fare poorly included the Audi e-tron (since rebadged as the Q8 e-tron) and Jaguar I-Pace, down 15% and 14% in value over 12 months, respectively.

The Tesla Model Y actually bucked the trend. Introduced to the UK market in March 2022, the compact SUV became the UK’s third best-selling car last year and demand was so strong that it gained 11.2% in value compared with its ageing stablemates.

But the scale of collapse in values of the Tesla Model 3, Model S and Model X is notable, and the UK statistics broadly tally with those observed in the United States in recent months.

Market forces

There appear to be a number of factors at play leading Tesla values to tumble so starkly compared to rivals, analysts said. Market saturation strong supply, high insurance costs, recent queues at charging stations and a largely elderly product line were factors, they said.

“We saw at the end of 2022 that the market for new Teslas was saturated, and the company had to heavily discount and pre-register to try and move stock. That will naturally push down the value of older examples,” said Tom Barnard, editor of Electrifying.com, speaking to Car Dealer.

“Many of the older Model 3s will have been bought on leases and are now being returned after three years, with a large proportion being sold on the open market where they will find a natural price level rather than through the managed Tesla-owned channels.

“The one big advantage Tesla still has is the Supercharger network, but the shine has been taken off by the opening up of some charge points to all EVs last year, and recent negative publicity surrounding queues at peak times.

“We also hear some private and business buyers are put off by Tesla’s high insurance rates, with groupings comparable to supercars.”

Another issue facing Tesla is the fact that, with the exception of the relatively new Model Y, the company’s product line-up no longer looks to be especially far ahead of its competitors who have rapidly caught up to the Californian firm in terms of technology and desirability.

Although it has been updated over the years, the Tesla Model S is largely the same car that launched back in 2012; the Model X launched in 2015, with the Model 3 following in 2017.

As the values of used Teslas are falling, so too is the company’s stock price as it appears that the firm has little in the immediate pipeline as regards new models. While a facelifted Model 3 is on the way, the Tesla Cybertruck (above, slated for this year) and Roadster have been significantly delayed.

In the meantime, start-ups including Rivian and Lucid have in some respects beaten Tesla at its own game, the former reaching the market with an all-electric pick-up in the United States ahead of even big establishment players such as General Motors, Ford and Stellantis.

Tesla’s undoubted popularity notwithstanding, the legacy car-makers that the firm once sought to “disrupt” have proven able to match and exceed the young upstart in terms of quality control, range and market reach.

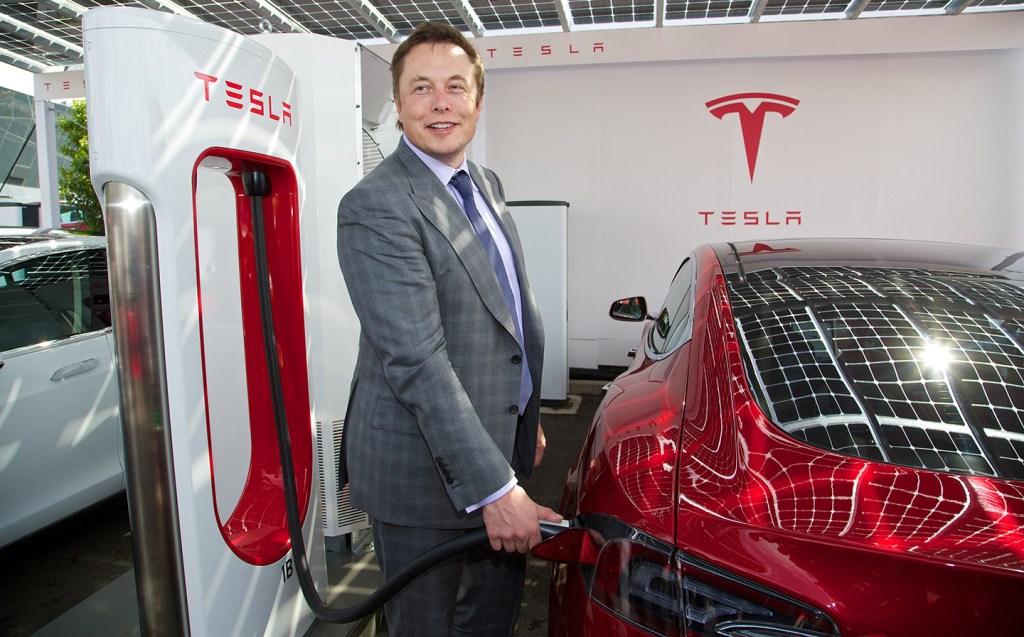

The Musk factor

Most of the issues currently affecting Tesla values seem to be economic ones related to supply and demand, but it appears that in a few cases at least, the erratic and bizarre behaviour of Musk, has tarnished the brand.

The entrepreneur, who also owns Space-X, Neuralink, OpenAI and the Boring Company, added microblogging site Twitter to his roster of responsibilities late last year after purchasing it for $44bn (£36.6bn) and has proceeded to air a wide range of polarising, politicised viewpoints.

Among other things, Musk has explicitly expressed support for the Republican party in the United States, staked a position as a free-speech absolutist and espoused scepticism regarding Covid-19 vaccines.

With Tesla owners generally leaning towards the liberal and Democrat end of the political spectrum, a minority of owners have said that Musk’s behaviour has put them off buying another Tesla, and some recent comments have contributed to their decision to buy a car from another brand.

John Byrne, a software CEO in Maryland, told Insider that Musk’s behaviour since he bought Twitter — including suggesting Anthony Fauci, America’s top infectious disease official, should be prosecuted over his handling of Covid-19 — was the final straw. Byrne traded in his Model X for an electric Audi e-tron GT towards the end of last year.

“I don’t want to be a brand ambassador for them anymore,” he told the publication.

According to some statistics, Tesla’s net favourability among Democrat voters fell by some 20% between October and November last year; favourability among Republicans only rose slightly.

The impact of Musk’s loose-cannon behaviour and right-wing opinions on the UK market isn’t clear, but the fact that new Tesla buyers may be facing into a staggering loss of value when they trade in their car for a newer model mayin itself cause some to rethink their purchase, and may be what ultimately causes real damage to the brand.

Related articles

- After reading about Tesla used values plummeting, you may want to read that Musk blamed the ‘fun police’ for a Tesla recall of nearly 600,000 cars

- Don’t miss this video of the Tesla-rivalling Lucid Air with 1,111hp recording a 2.88sec 0-60mph time

- It’s also worth noting that a Tesla Autopilot report recently showed an improving safety record

Latest articles

- Omoda 5 prototype review: Bargain family SUV is solid first effort for new Chinese brand

- Dacia Duster 2024 review: Rugged, affordable SUV modernised with electrification and quite the glow up

- Audi A3 Sportback 2024 review: Softly, softly, catchy premium hatchback buyer

- New electric-only Mini Aceman fills gap between Mini Cooper hatch and Countryman SUV

- Tesla driver arrested on homicide charges after killing motorcyclist while using Autopilot

- Porsche Macan 2024 review: Sporty compact SUV goes electric, but is it still the class leader for handling?

- F1 2024 calendar and race reports: What time the next grand prix starts and what happened in the previous rounds

- Aston Martin DBX SUV gets the interior — and touchscreen — it always deserved

- Nissan unveils bold look for updated Qashqai, still made in UK