Number of ultra-rapid chargers for electric vehicles increased 40% in first six months of 2022

Longer journeys getting easier

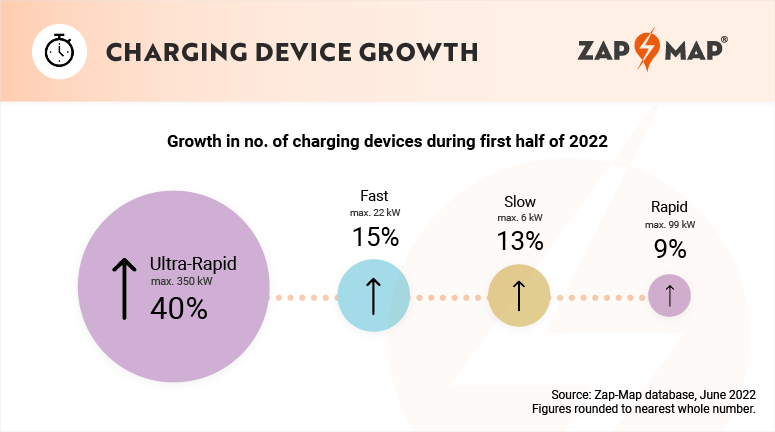

The number of ultra-rapid electric vehicle chargers in the UK has increased by 40% in the past six months, according to the latest figures released by the charging app company, Zap-Map.

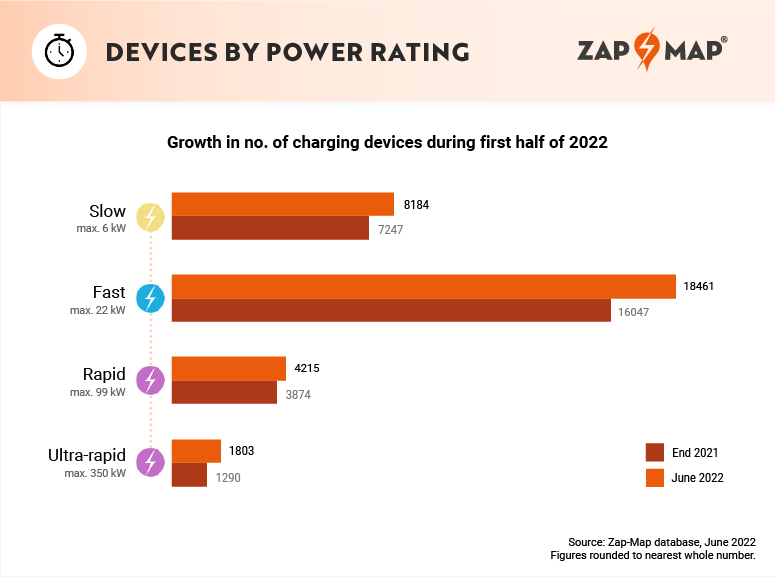

Ultra-rapid DC chargers, which operate at capacities between 100kW and 350kW, are primarily aimed at EV drivers covering longer distances who need to recharge as quickly as possible, and at the end of 2021 there were just 1,290 examples in the UK.

An increase of 40% during the first half of 2022 brings that figure to 1,803, although comparably, the number of ultra-rapid chargers versus rapid (up to 99kW) and fast (up to 22kW) chargers remains small, with 4,215 and 18,461 charging devices respectively.

The growth in ultra-rapid charge points is largely due to networks such as MFG EV Power, InstaVolt, Fastned and Gridserve Electric Highway rolling out high-speed charging “hubs” (not dissimilar in many cases to old-fashioned filling stations) of at least six devices across the country, according to Zap-Map. Traditional petrol retailers such as Shell and BP Pulse are also adding many more ultra-rapid chargers to their forecourts.

The total number of charging points across the UK has grown by almost 15% (from 28,458 to 32,663) since the end of December.

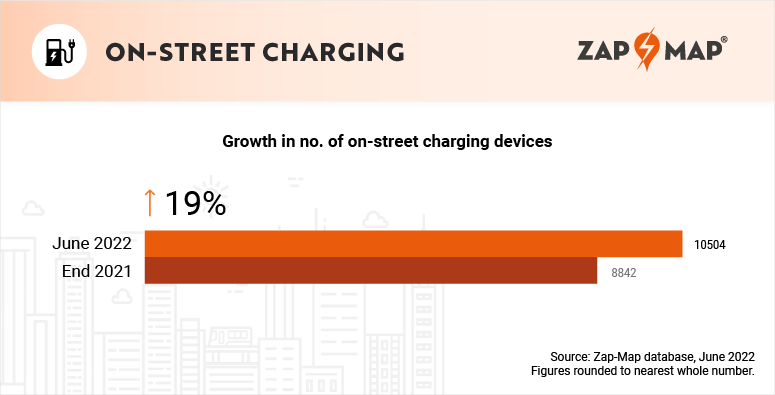

Of the 4,205 new devices installed this year, 1,662 are on-street chargers, usually found on residential streets and aimed at providing an alternative to home charging. The number of these chargers has increased by just under 19% in 2022 so far, growing from 8,842 at the end of 2021 to 10,504 at the end of June.

The growth in the number of on-street chargers is primarily down to one company — Ubitricity, which is art of the Shell group — which mostly fits slow (up to 6kW) chargers into lamp-posts. Drivers need only plug in their car using a standard “Type 2” charging cable and then start the charging process via a mobile app.

Out of the 1,662 on-street chargers installed, Ubitricity fitted 981 with the remainder being installed by companies such as Connected Kerb and Char.gy.

Of the 4,205 new devices installed overall, 49% were fitted by just five companies: Ubitricity, Pod Point, Instavolt, Char.gy and VendElectric.

North East gets biggest charging infrastructure boost

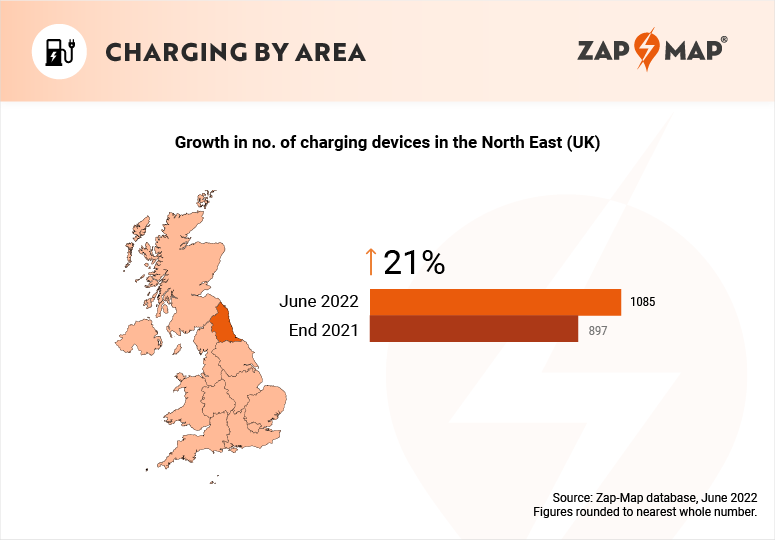

Across the UK, there are differences in the speed of charging point instalations.

The North East of England saw the highest rate of growth in chargers so far this year, with the number of charging devices increasing by 21% in the first six months of 2022, a rise from 897 at the end of 2021 to 1,085 in June.

There was significant growth in the East of England, with 2,097 chargers by the end of June compared with 1,775 at the end of 2021, representing an 18% increase.

However, Greater London received the highest total number of charger installations this year, increasing from 9,160 devices at the end of 2021 to 10,865 at the end of June — an increase of more than 18%.

“We know there are a variety of use cases for electric vehicle chargers, more so than with a petrol or diesel vehicle, so it’s really encouraging to see the UK’s charging infrastructure showing growth in a number of different areas,” said Melanie Shufflebotham, the chief operating officer at Zap-Map and one of the firm’s co-founders.

“The 40% increase in the number of ultra-rapid chargers is clearly the headline figure so far in 2022. These types of chargers make longer journeys far easier, so the big increase should really mean we see an end to range anxiety.”

Slower chargers still ‘critical’

Shufflebotham said slower chargers also have a critical role to play for people who ant an electric vehicle but don’t have off-street parking.

“They might not provide the excitement of adding hundreds of miles in minutes,” she said, “but with more than half a million pure-electric cars now on UK roads, their part to play in the adoption of electric cars is just as important as their ultra-rapid counterparts.

“It’s crucial that the rollout of high-speed charging hubs continues at pace, alongside the increasing provision of on-street chargers for those without driveways, ideally with local councils engaged along the way.”

Ultra-rapid charging hubs are smart business

While the number of ultra-rapid chargers remains small, the scale of the uptick is indicative of the business case to be made for such devices. With travellers willing to pay a lot more per kilowatt-hour of electricity for the convenience and time-saving of rapidly replenishing their batteries, companies can charge quite a lot more than domestic rates.

Ultra-rapid chargers cost an average of around 50.97p/kWh though can rise as high as 65p/kWh, which compares with 7.5p/kWh for off-peak home charging via Octopus Energy, which is a popular energy company for EV drivers though just one of several with time-of-use tariffs.

According to research earlier this year by the RAC, the average cost of charging on a pay-as-you-go, non-subscription basis at a publicly accessible rapid charger in Great Britain is now 44.55p/kWh.

With the average cost standing at 36.74p/kWh back in September 2021, prices had risen 21% between then and when the research was published at the end of May.

As a result, the RAC said that the cost of recharging the 64kWh battery of a “typical” family electric car to 80% has increased by £4 since September, hitting £22.81. At an ultra-rapid charger, prices are higher still, costing on average £26.10 to charge the same battery to 80%. Costs per mile are still much less than equivalent petrol and diesel cars, with fuel price rises meaning the cost of filling an average tank has now exceeded £100 for the first time.

Related articles

- After reading that the number of ultra-rapid chargers for electric vehicles has increased 40% in first six months of 2022, you might like to see the government’s pledge of £500m to increase number of EV charging points tenfold by 2030

- Check out our electric vehicle reviews here

- And if you’d like to read about all the car makers’ electric vehicle plans, click here

Latest articles

- Aston Martin Valkyrie AMR-LMH hypercar hits track ahead of 2025 Le Mans challenge

- Porsche has begun testing the electric Cayenne

- Cupra Leon 272 eHybrid 2024 review: Bigger battery, better tech … but is it a Cupra?

- Porsche 911 GTS 2024 review: Hybrid heresy or more Stuttgart genius?

- Extended test: 2023 Vauxhall Astra Sports Tourer GS PHEV

- Ford Capri revival has faced a lot of flak… but are buyers put off? Here’s what visitors to the Festival of Speed had to say

- F1 2024 calendar and race reports: What time the next grand prix starts and what happened in the previous rounds

- ‘No timeframe’ for how long Volvo’s returning estate cars will be on sale in UK

- Kia Picanto 2024 review: Updates add spice to cute Korean city car