Car production in the UK plummets to near 10-year low

Sharp fall is of 'grave concern'

THE NUMBER of cars rolling off production lines in the UK has continued to decline, falling to its lowest level for almost a decade.

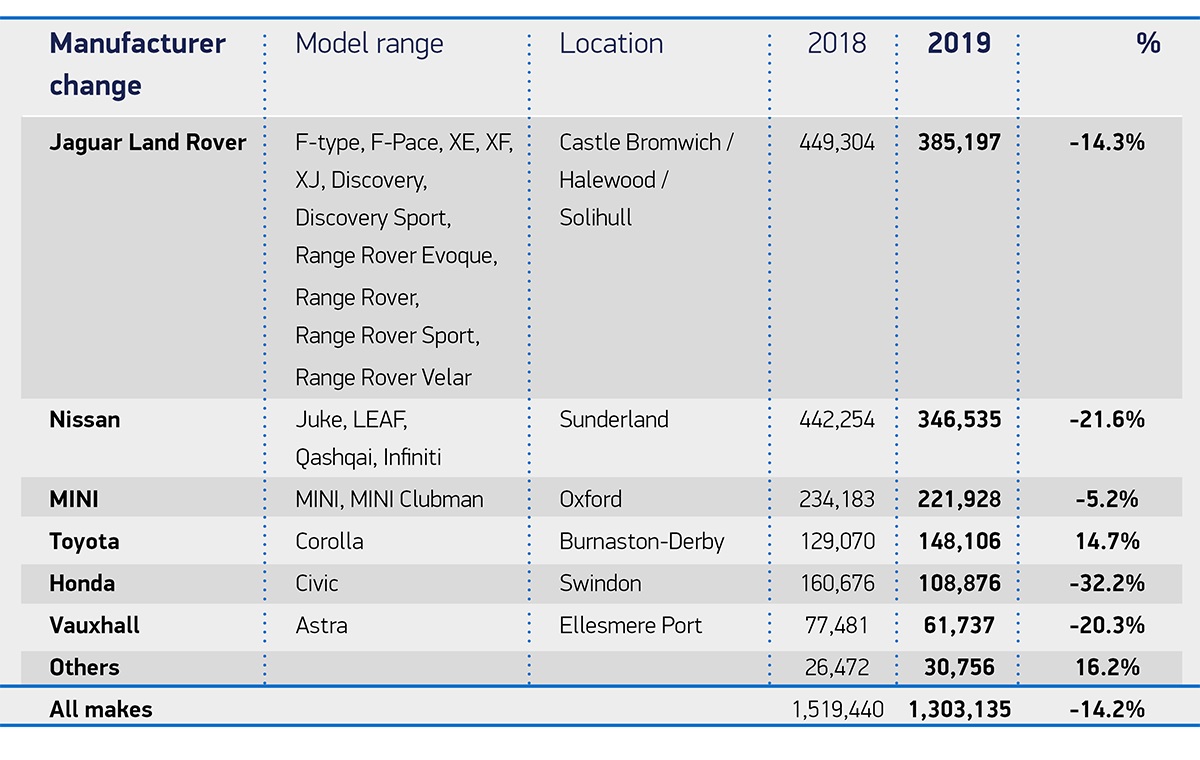

Data published by the Society of Motor Manufacturers and Traders (SMMT), the trade body that represents the UK car industry, shows British car factories built 1.3m vehicles in 2019 — making last year the least productive for British car makers since 2010, when 1.27m cars were built.

As well as marking a third consecutive year of decline since annual car production peaked for the decade in 2016, when UK factories churned out 1.72m vehicles, the figures for 2019 also show a very sharp year-on-year drop. Last year’s total is 14.2% down on the 1.52m models that left UK factories in 2018; the sharpest annual fall since car production plunged by 30.9% in 2009, in the wake of the 2008 global financial crisis.

While ongoing uncertainty over the UK’s future relationship with the European Union (a long-running concern for car makers based in Britain) has been attributed to the fall, the SMMT doesn’t believe it’s the only reason behind the drop. According to the trade body, other factors such as the declining popularity of diesel-powered vehicles and “a number of significant model production changes” have also played a part in UK car production falling in 2019.

Despite a decline in domestic demand for new cars being a factor, the vast majority of models built in Britain are exported. Of the 1.3m cars assembled over the last 12 months, just over 1m were shipped overseas, with around 578,000 of them finding new homes in the 27 other European Union member states, down 11% in the year.

America, which accounted for 19% of exports, took 10% fewer cars. Sales to China, which account for more than 5% of exports, fell by 26% on the back of Beijing’s trade war with the US. Sales to Japan, which accounts for more than 3% of exports, fell by 17%.

“An ambitious free trade agreement with Europe that guarantees all automotive products can be bought and sold without tariffs or additional burdens is essential”

Considering how many British-built cars are sold in Europe, the SMMT has urged the UK Government to pursue a Brexit deal that keeps Britain as closely aligned to the European Union as possible.

The SMMT’s chief executive Mike Hawes said: “Given the uncertainty the sector has experienced, it is essential we re-establish our global competitiveness and that starts with an ambitious free trade agreement with Europe, one that guarantees all automotive products can be bought and sold without tariffs or additional burdens.

“This will boost manufacturing, avoid costly price rises and maintain choice for UK consumers. Negotiations will be challenging but all sides stand to gain and this sector is up for it.”

Regardless of the terms of that future relationship, it isn’t expected to stop car production in the UK falling even further over the next 12 months.

Honda has confirmed its factory in Swindon, which produced 108,876 Civic hatchbacks in 2019 (around 8% of Britain’s total car output last year), will be shut down by the end of 2021; a decision the Japanese car maker claims was made “in response to global changes in the automotive industry“.

The fate of the Vauxhall Astra factory in Ellesmere Port is also up in the air, as Vauxhall’s parent company Groupe PSA has confirmed its decision on whether or not to build the next generation Astra there “will be conditional on the final terms of the UK’s exit from the European Union”.

Groupe PSA has also confirmed the estate version of the new Astra will be built in Germany by Vauxhall’s sister brand Opel, due to the strong demand for estate cars in continental Europe.

However, despite the 170,000 drop in production at Honda and Vauxhall, an independent forecast for the SMMT indicates production in 2020 will only fall marginally to 1.27m, putting it on a par with the 2010 output figure. This would be possible thanks to continued success at Toyota’s plant in Burnaston, Derbyshire, which saw output rise by 14% last year, after it switched production to mainly hybrid Corolla models, and a recovery in output at Jaguar Land Rover and Nissan.

Tweet to @J_S_Allen Follow @J_S_Allen

SMMT: Brexit uncertainty has done ‘enormous damage’ to UK car industry

Honda confirms its Swindon car factory will definitely close by 2021