Electric cars outsold petrol models in the UK last month

Still a tough road ahead, warns SMMT

Pure-electric cars took an impressive 32.9% share of the UK car market in December, a figure that marks the biggest ever monthly market share for EVs and one which was higher for the month than even petrol-powered models.

The latest figures from the Society of Motor Manufacturers and Traders (SMMT) show pure-electric cars scooping a 16.6% total market share for 2022, still some way behind traditional petrol models on 42.3%, but well ahead of diesel and hybrid vehicles.

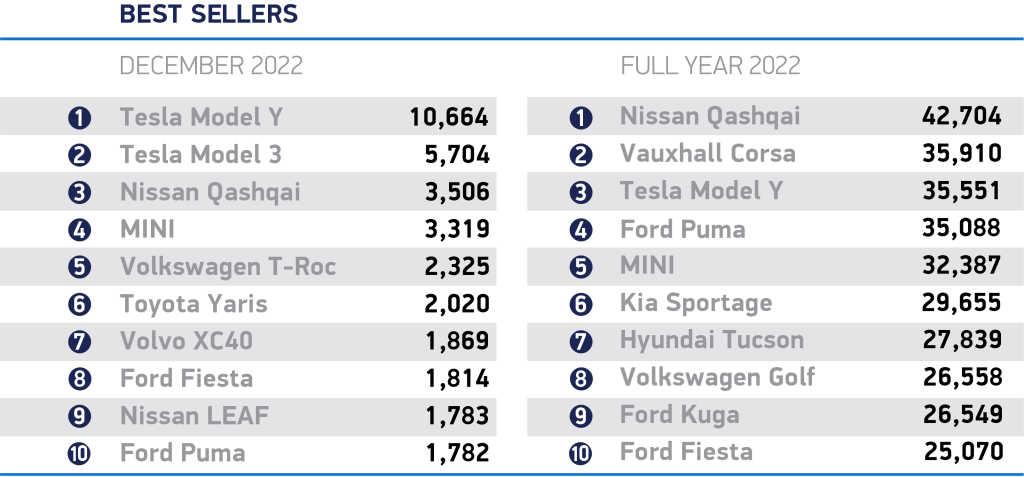

The end-of-year figures for electric vehicles were bolstered by the arrival late in the year of a shipment of new Tesla models, which saw the firm’s Model Y crossover shoot to the top of the sales charts for the month with 10,664 sales, followed the company’s saloon, the Model 3, on 5,704 units.

That late rally from Tesla was enough to propel the Model Y into third place in the overall 2022 UK car sales charts, with 35,551 sales for the year, placing it ahead of the Ford Puma, which had been expected to take third place behind the Nissan Qashqai and 2021’s best-seller, the Vauxhall Corsa.

Tesla’s Model Y and Model 3 and the Kia Niro EV were, respectively, the three best-selling electric vehicles in 2022.

While private purchases accounted for just over half of all car sales in 2022, business and fleet sales made up the majority (66.7%) of battery-electric vehicle purchases, underscoring how attractive BEVs remain as company cars due to their low 2% Benefit-in-Kind tax rate.

Electric vehicles increased their market share in 2022 by 40.1% compared to 2021, but although that represents the highest number of BEVs yet sold in the UK, the rate of increase has slowed compared to previous years.

This perhaps adds further credence to the idea that the exponential number of EV sales in recent months may be as a result of supply chains unknotting themselves following two years of strangulation due to a combination of factors, chiefly the global semiconductor shortage.

“The automotive market remains adrift of its pre-pandemic performance but could well buck wider economic trends by delivering significant growth in 2023,” said Mike Hawes, chief executive of the SMMT.

“To secure that growth – which is increasingly zero emission growth – government must help all drivers go electric and compel others to invest more rapidly in nationwide charging infrastructure.

“Manufacturers’ innovation and commitment have helped EVs become the second most popular car type. However, for a nation aiming for electric mobility leadership, that must be matched with policies and investment that remove consumer uncertainty over switching, not least over where drivers can charge their vehicles.”

According to the SMMT, the government’s EV Infrastructure Strategy forecast that the UK would require between 300,000 and 720,000 charge points by 2030 in light of the planned ban on the sale of new petrol and diesel cars by the end of the decade.

Even meeting the lower figure, it said, would require more than 100 new chargers to be installed every single day; the current rate is around 23 per day.

Plans to introduce Vehicle Excise Duty (VED — colloquially known as “road tax”) on BEVs from 2025 with the same “premium” threshold as internal combustion-engined cars will, the SMMT said, disproportionately penalise those making the switch to electric vehicles.

Higher production costs, the body pointed out, mean that more than half of all BEV registrations in 2022 would have incurred the “premium” VED rate if it had been in place, a move that risks discouraging wider adoption.

The SMMT also said that supply-chain problems had not gone away and that the erratic supply of semiconductors and other vital parts would likely continue to affect car production throughout 2023.

Related articles

- After reading about increased sales of BEVs in the UK, you might be interested to read our review of the Volkswagen ID.5 GTX

- Keen to go electric? Here are the top 10 longest-range electric cars

- Check out the best-selling cars of 2022

Latest articles

- Aston Martin Valkyrie AMR-LMH hypercar hits track ahead of 2025 Le Mans challenge

- Porsche has begun testing the electric Cayenne

- Cupra Leon 272 eHybrid 2024 review: Bigger battery, better tech … but is it a Cupra?

- Porsche 911 GTS 2024 review: Hybrid heresy or more Stuttgart genius?

- Extended test: 2023 Vauxhall Astra Sports Tourer GS PHEV

- Ford Capri revival has faced a lot of flak… but are buyers put off? Here’s what visitors to the Festival of Speed had to say

- F1 2024 calendar and race reports: What time the next grand prix starts and what happened in the previous rounds

- ‘No timeframe’ for how long Volvo’s returning estate cars will be on sale in UK

- Kia Picanto 2024 review: Updates add spice to cute Korean city car