Tesla led an automotive revolution but being first doesn’t always mean winning

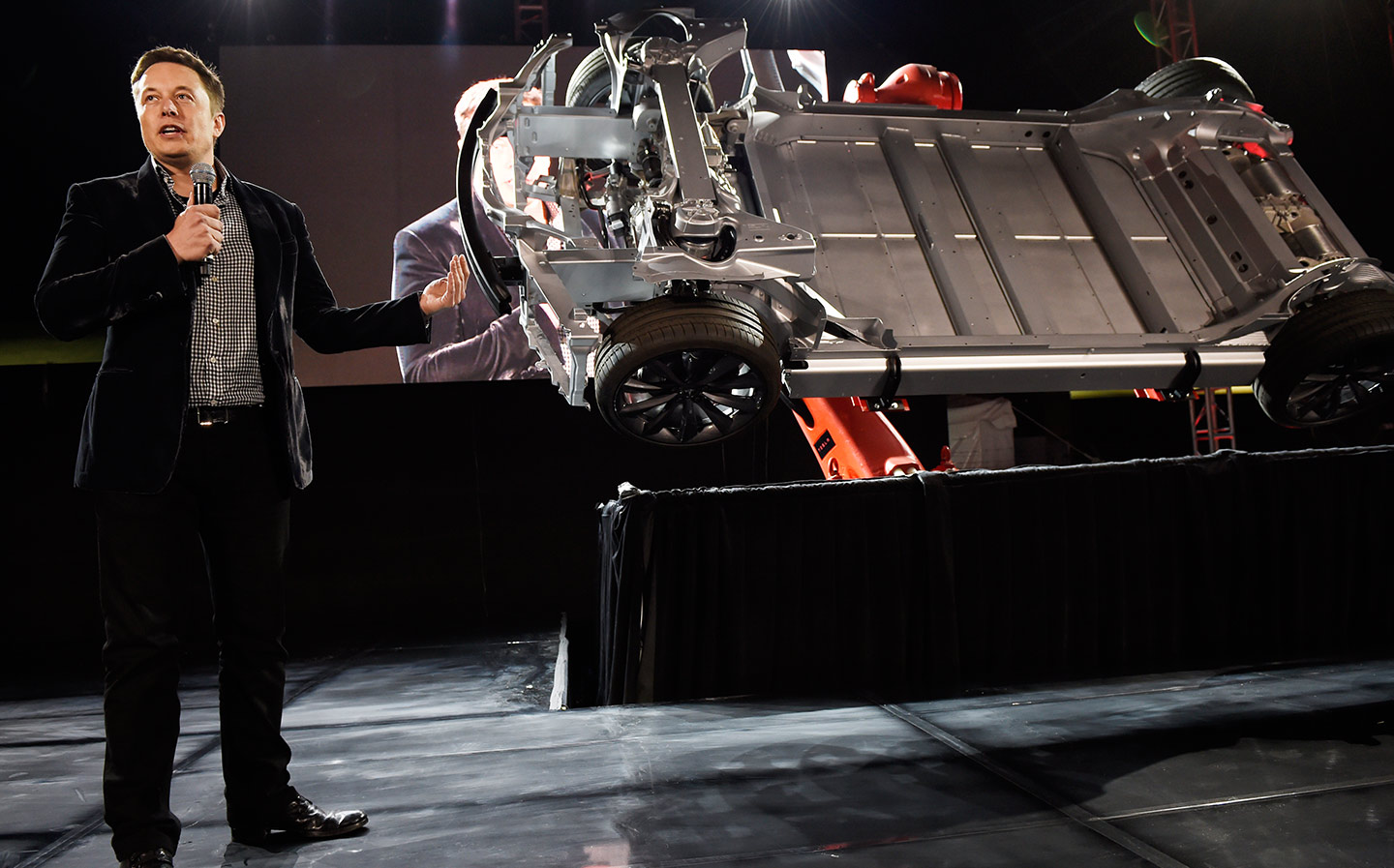

Elon Musk's company definined the electric sports, but the big fish are catching up

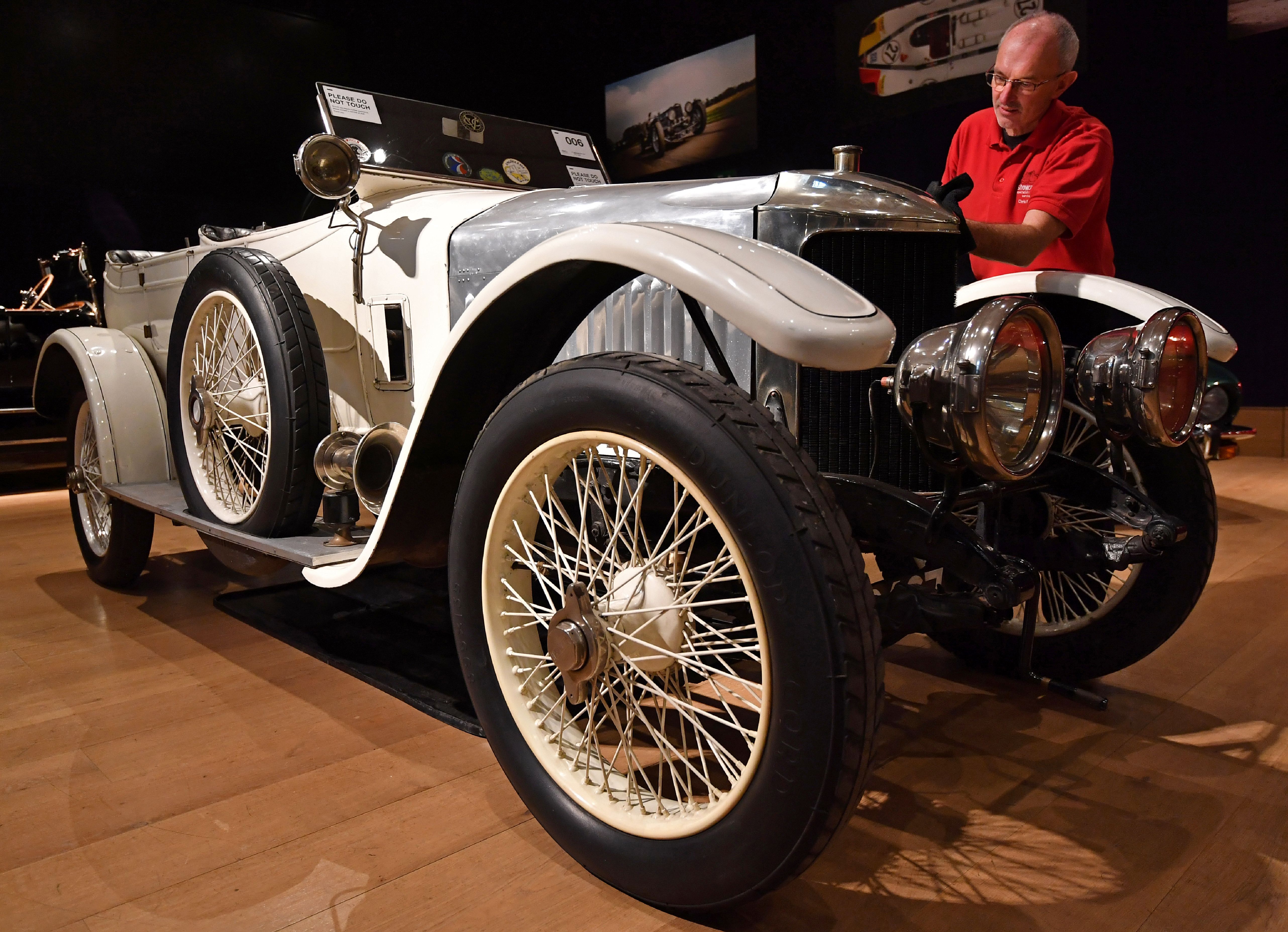

IN 1910 a south London company not long since known as the Vauxhall Iron Works produced a vehicle that changed the world of motoring. The Ford Model T was already bringing the automobile to the masses, but the Vauxhall Prince Henry opened the eyes to what a motor car could be.

A 1914 Prince Henry Vauxhall, part of a Bonhams auction in 2016.

The Prince Henry was the world’s first supercar*, its speed and power a result of excellent design and brilliant engineering. It was the vehicle that became the staff cars of British officers during the First World War. It spawned the Vauxhall E-type, the great sportscar of the 1920s and arguably the vehicle that caught the eye of the Americans which led to the acquisition of Vauxhall in 1925 by General Motors.

The point of the story of Vauxhall and those of countless other marques that sprang up at the dawn of the automotive era, is this: no one can tell where a particular technology or its brand will end up. In the case of Vauxhall some will be shocked to know it was once at the cutting edge of engineering, designing some of the most beautiful and powerful cars of their age, just as even now many still believe it to be a British company.

Browse NEW or USED cars for sale

Ask people to put the words electric and sports car together and the answer you get is Tesla. Tesla is the electric sports car. Except of course it isn’t. It might have been five years ago but on the one hand Elon Musk has gone mainstream and on the other Big Auto has woken up to the possibilities of automotive electrification and the appetite of consumers to acquire them (or at least to be incentivised to lease them).

Tesla’s Roadster, Model S, Model X and Model 3 are great cars. But they are not that great. And as Big Auto fully embraces electrification, the differential between what a Mercedes-Benz or a BMW or a Nissan produces and what Tesla offers will disappear. Every car from a conventional manufacturer whose dust covers are removed at a glitzy motor show is tagged as the next Tesla killer, the vehicle that overcomes the upstart.

Tesla is a Californian car and battery maker with a workforce of 33,000 and a stock market value of $53bn. It was founded 15 years ago by Mr Musk, a 46-year-old South African-Canadian who used his degrees in physics and economics to make a packet in the dotcom boom. He now has a wide range of commercial interests and dreams which include cars and putting man on Mars.

“It is a market in which the existing players have much vested interest to ensure that Tesla does not win”

Earlier this month Tesla reported a 66% growth in revenues to $11.7bn in 2017. That growth rate had slowed in the final quarter to less than 50% when losses more than tripled taking the company roaring into the red to the tune of $2.2bn for the year from $773m in 2016. About 10% of its business comes from the use of its batteries for energy generation and storage.

Like many a conventional car company before it, Tesla is having production problems and delays, specifically with the Model 3, an issue that is magnified in a business which in manufacturing terms is learning its trade.

It says that it will this year produce 100,000 vehicles. For context, General Motors which has a not dissimilar stock market value sold 9.6m vehicles.

With GM what you see is what you get. In Tesla you are buying the future or in Mr Musk’s words “a new chapter of our journey [in which] hundreds of thousands of people will switch to our electric vehicles and many others will turn their houses into near self-sufficient energy generators.”

Browse NEW or USED cars for sale

The only problem with this is the word “our”, Tesla’s assumed ownership of a market in which it is leading change. But it is not alone. It is a market in which the existing players have much vested interest to ensure that Tesla does not win.

That the automotive market changes more in the next five years than it has done in the past 100 is already an industry cliché. Picking who the winners are is difficult. One certainty is that this is not a short-term game and tens upon tens of billions of dollars will be spent trying to be that winner.

What Tesla has already is public recognition, a brand. But there is no saying that like Vauxhall 100 years ago, leading technological change does not prevent you from being sucked into the wrong end of lower margin commoditisation. Backing any automotive stock is like a bet on the year that man reaches Mars.

This article first appeared in The Times’ Tempus column, edited by Martin Waller, which analyses corporate news and attempts to give investment advice.

*Contestable — Ed.

Elon Musk and SpaceX successfully launch Tesla Roadster and ‘Starman’ driver to Mars