What is road tax (VED) and how much does it cost?

Swot up on tax bands before you invest

THE ROAD fund licence for vehicles registered since March 1, 2001, comprises stepped tax bands based on carbon dioxide emissions.

Search for and buy your next car on driving.co.uk

Of conventional petrol and diesel-engined vehicles, those emitting less than 100g/km of CO are classed in band A and have nothing to pay. Band B cars (101-110g/km) cost £20 a year to tax from its second year after registration.

The first year is free for band A-D cars – and reduced in the first year for higher bands – under the “showroom tax” rules that were introduced in 2010 to encourage us to buy greener models.

The bands go up to M (more than 255g/km; £1100 in the first year and £505 a year after that).

Alternative-fuel vehicles ‒ electric, hybrid, factory-built “flex-fuel” vehicles ‒ are classed in the same way but with a £10 reduction on the tax.

Cars registered before March 1, 2001, are simply taxed by engine size: currently £135 a year up to 1549cc and £220 for larger engines. “Historic” cars registered before January 1, 1973, are tax-exempt, though owners still need to display a free tax disc. If your car is off the road and untaxed, you must make a SORN (statutory off-road notification).

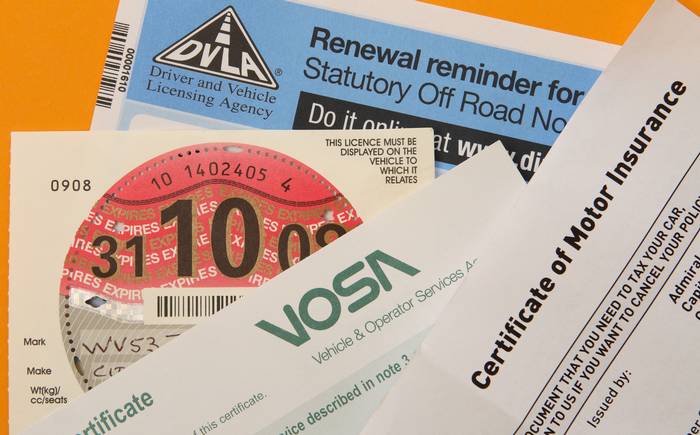

Tax discs, as shown in the picture, were abolished at the end of 2014 and no longer need to be displayed in the windscreen. These days all information about whether or not a vehicle is taxed is stored on a central computer database.

Be warned: when buying and selling it a car under the current rules, tax is not transferable and new owners will need to tax the car themselves. Also under the current rules you have to pay for the current month in full, meaning if you apply at the end of the month you’re paying for a period of up to 30 days prior to owning the car. In May 2015 it was estimated that the government was making £38m a year by double-charging drivers for vehicle tax.

More details on taxing a car can be found at Directgov.