Coronavirus is lowering car insurance premiums for young drivers

Now is the time to get in contact with your insurer, whatever your age

EVEN IF you’re only using your car to drive to the supermarket every other week during the current coronavirus lockdown, it still has to be insured, of course. However, the lack of cars on the road has led to fewer insurance claims, and it’s possible that this could translate into cheaper premiums, according to price comparison website Comparethemarket.com.

A large percentage of the workforce are currently working from home or furloughed, whereby a company can grant a leave of absence to an employee and then claim 80% of their wages, up to £2,500 per month, from the government. The Institute for Fiscal Studies (IFS) estimates that 22% of working-age adults are key workers. The other 78%, if not furloughed, should be working from home.

This means that the roads are comparatively empty of people, apart from the sector of the population who qualify as key workers, many of whom are continuing to go to work in order to provide essential services during the crisis.

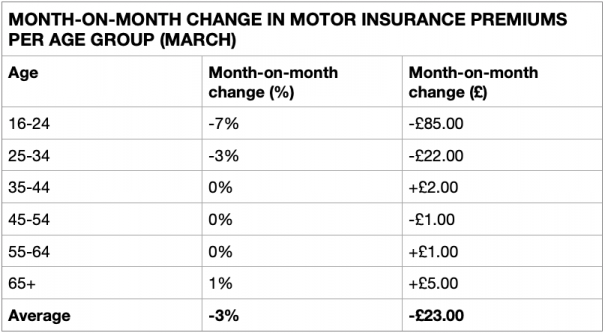

Data provided to Driving.co.uk by Comparethemarket.com shows a month-on-month decrease in insurance premiums for some age groups.

The good news comes to younger drivers, with people under the age of 35 seeing a decrease in motor insurance premiums over the last month. People who still get ID’d buying wine might find themselves with a bit more pocket money, with insurance dropping £85 month-on-month for 16-24 year-olds, representing a 7% decrease. While drivers can gain a driving licence from age 17, you can learn to ride a moped and take a moped test at 16.

Those in the 25-34 age bracket also saw a month-on-month decrease of 3%, which in pounds and pennies comes to about £22.

Middle-aged and elderly people don’t have much to celebrate, however. Insurance premiums for people aged over 35 have remained largely the same, according to Comparethemarket.com, with the largest monthly deviation being a £5 increase for those aged 65 and over. Overall, insurance premiums dropped by an average of £23, but at the moment the only people reaping this benefit are those under 35 years of age.

However, this is only the beginning of what could be a long period of less cars on the road and Dan Hutson, Head of Motor at Comparethemarket.com, told Driving.co.uk that insurance premiums are likely to go down in concert with the number of claims.

“The Government has reported a near 70% reduction in motor vehicle use across the country,” he said. “The full effect of this on the price of car insurance has yet to be seen, however we expect premiums to be pushed down even further.”

If you are furloughed, renegotiate your insurance

If you are over 35, there are still a few things you can do that might push your premium down, especially if you’re one of the majority of the workforce who is now working from home, or furloughed. “If you are no longer commuting and are going to be working from home for the foreseeable future, there is a chance your provider could reduce your premium,” said Hutson.

Most of us can expect our annual mileage to decrease significantly, as there are now only four reasons that you are allowed to leave the house. A reduction to your anticipated annual mileage could also affect your premium, so it’s worth letting your insurance company know.

If the lack of reasons for you to use your car has meant that it’s now stored somewhere different, that could also save you a bit of cash, especially if the place where it now resides means that it is more protected from theft or damage.

Hutson said: “If you’re not going to be using your car and want to keep it somewhere different to the place specified on your insurance policy (for instance, moving it from the street to a garage) you should let your insurance provider know, as storing your car off the street could reduce your risk profile.”

So, depending on your age, you could see an immediate silver lining from this lockdown in the form of cheaper insurance. It’s likely that this will begin to benefit of all ages before long, so be patient — but in the meantime, it’s worth getting on the phone to your insurance company to see if you can save a bit of money, in a time when a lot of people need to find ways to save wherever possible.

Tweet to @KieranAhuja Follow @KieranAhuja

Coronavirus leads to bigger drop in car sales than after financial crash