Budget 2015: low-emission cars hit hardest in chancellor's road tax reforms

BUYERS OF some of the most frugal cars will be hit hardest in the pocket under changes to vehicle excise duty announced by the chancellor in Wednesday’s budget.

Under the new rules, which come into effect on April 1, 2017, and affect only vehicles registered on or after that date, all but zero-emission electric vehicles will incur a flat annual fee.

The rate in the first year is banded by CO2 emissions and ranges from £10 to £2,000. In the second year it changes to a standard £140 a year, except for the most expensive models, whose owners are liable for a surcharge.

Browse NEW or USED cars for sale

The Society of Motor Manufacturers and Traders, which represents car companies, said it was concerned about the change because it removed some of the incentive to buy more efficient cars, as owners would pay the same rate as most other drivers.

Vehicles emitting, say, 99g/km of CO2 are exempt of duty under the current rules. The changes will mean that the vehicles are subject to a tax of £120 in year one, followed by an annual charge of £140 from year two.

A Mercedes S 300 hybrid, which emits 120g/km of CO2, currently costs owners £100 in tax over six years. If the same model were to be purchased in April 2017, it would cost £2,410 over the same period

In addition, any cars that cost more than £40,000 new will attract an extra fee of £310 a year for years two to six, amounting to a bill of £450 a year, regardless of how polluting they are.

Drivers of expensive but frugal cars will be hit hardest by the changes. Today, bought new, a Mercedes S 300 hybrid, which emits 120g/km of CO2, will cost owners £100 in tax over six years. If the same model were to be purchased in April 2017, it would cost £2,410 to tax over the same period.

Drivers are also being warned that a car with a base price just short of £40,000 could end up falling into the bracket for the supplementary charge once options are added.

Cars costing more than £40,000 account for about 6% of sales in Britain, according to Jato Dynamics, which compiles information on the car market.

However, the chancellor claimed that many drivers would see a reduction in the amount of tax they pay, especially if trading in a second-hand car with high CO2 emissions.

| Emissions (g/km of CO2) | First year rate | Standard rate (from year two) | Surcharge for cars over £40,000 (years two to six) |

| 0 | £0 | £0 | £310 |

| 1-50 | £10 | £140 | £310 |

| 51-75 | £25 | £140 | £310 |

| 76-90 | £100 | £140 | £310 |

| 91-100 | £120 | £140 | £310 |

| 101-110 | £140 | £140 | £310 |

| 111-130 | £160 | £140 | £310 |

| 131-150 | £200 | £140 | £310 |

| 151-170 | £500 | £140 | £310 |

| 171-190 | £800 | £140 | £310 |

| 191-225 | £1,200 | £140 | £310 |

| 226-255 | £1,700 | £140 | £310 |

| Over 255 | £2,000 | £140 | £310 |

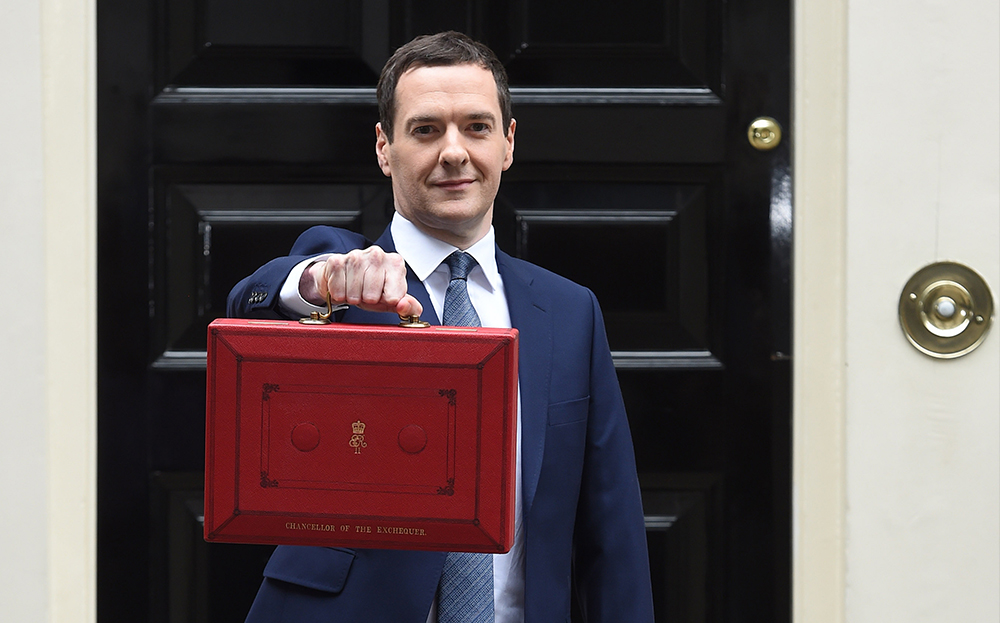

George Osborne also announced that the road fund will return after 80 years: money paid by drivers will be ring-fenced for spending on motorways and trunk roads for the first time since 1936.

Motoring groups welcomed the change, saying that the funding would guarantee the delivery of planned road improvements and go some way to solving the problem of potholes — for years the bane of drivers’ lives. But they pointed out that the settlement does not cover local streets, which make up 97 % of Britain’s roads and will still be maintained by councils, which will not have access to the fund.

Revenue from road tax is predicted to be about £6bn a year. This money will be split between Highways England, which manages motorways and trunk roads in England, and authorities in Scotland, Wales and Northern Ireland.

“This paves the way for a new relationship between drivers and the people who run and look after our road network,” said Steve Gooding, director of the RAC Foundation. “When we are invoiced for our payment we should expect to receive a report on where and how the money is being spent.”

As well as road tax, drivers paid £26.5bn to the Treasury in petrol and diesel duty last year. That tax remains frozen for the rest of the year. Insurance premiums will rise because of an increase in insurance premium tax from 6% to 9.5%.