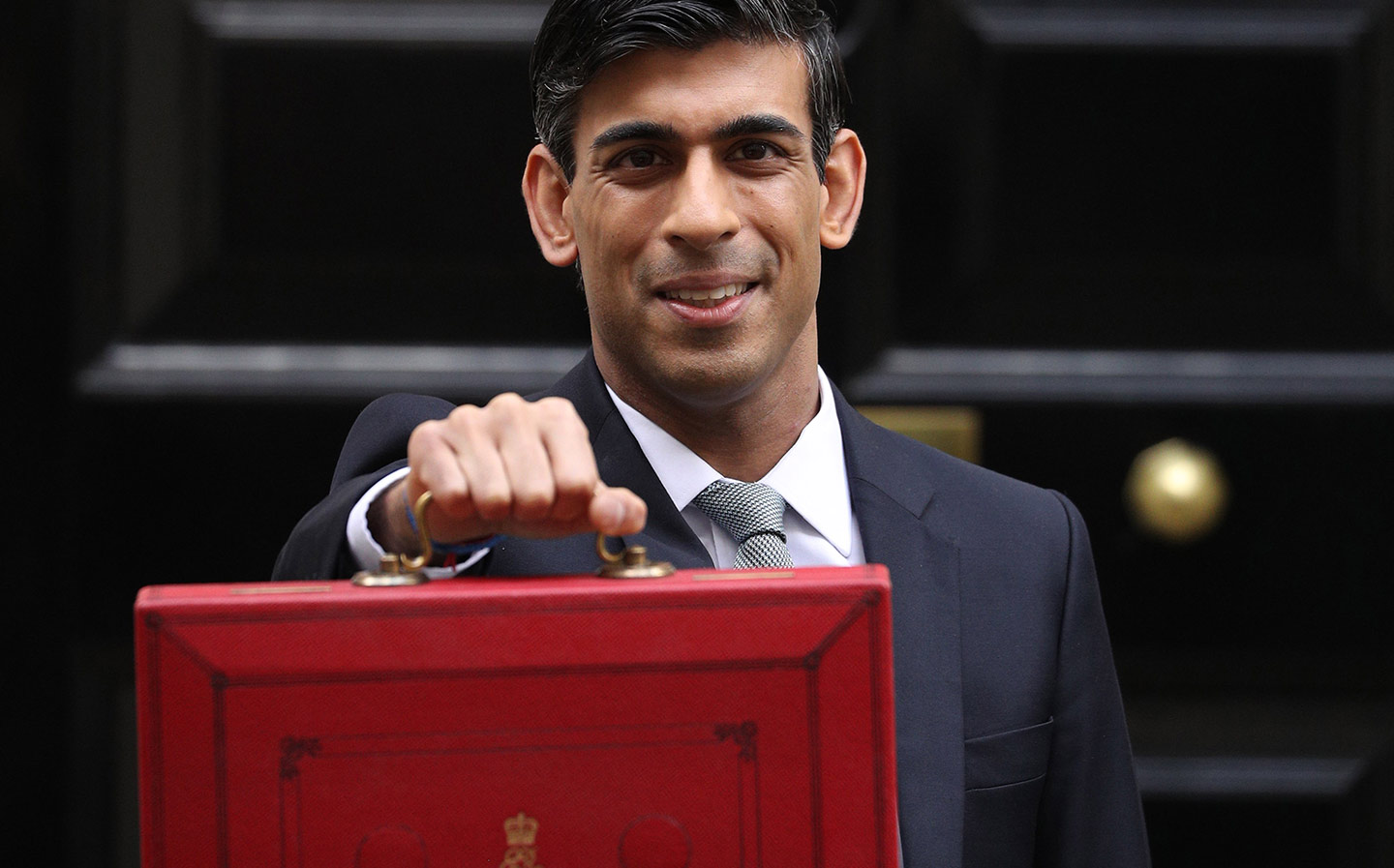

Budget 2020: Chancellor Rishi Sunak outlines plans for roads and cars

Hey, big spender

NEW CHANCELLOR of the Exchequer Rishi Sunak has been in the job for less than a month, and he arrives at a time of potential economic turmoil. The Covid-19 coronavirus is creating havoc for businesses, with “up to a fifth” of the workforce facing being forced to take time off work, and negotiations with the European Union over our future relationship continue, ahead of our departure from the bloc at the end of the year. So today’s Budget was not only his first real test but potentially the trickiest in years.

Did Sunak come out of it with flying colours? Check out his key announcements on the issues that affect motorists, including fuel duty, potholes, electric cars and more.

Road repairs and upgrades

The government had already promised to level up transport infrastructure, and the chancellor today pledged £27bn in “new Tarmac” for roads and motorways, which he called the biggest ever investment in the “strategic road network”. Sunak also promised a £2.5bn pothole fund — £500m every year over the term of the parliament — which he said was enough to fill 50m potholes.

Sunak also committed to the completion of the Caernarfon and Bontnewydd bypass in Wales, which he said would protect villages in the Welsh borders.

And for those who’ve endured holiday traffic hell on the A303, which runs from Basingstoke in Hampshire to Honiton in Devon, with snarl-ups in particular around Stonehenge in Wiltshire, Sunak committed to promised works intended to improve traffic flow. Governments have been trying to fix the issue since the 1980s, he said, but now this parliament would “get it down” — a mantra repeated throughout Budget 2020.

Edmund King said: “During the election, the Prime Minister promised the biggest ever pothole fund of £2bn. We are glad he has kept his word and even provided an extra £500m to the fight the cause. While it will fill over 50m potholes, there will still be some way to go before our local roads are completely smooth. Councils receiving their funds should be urged to focus on resurfacing rather than patching.

“The £27bn investment in the nations motorways and major roads is fantastic news. Improvements to roads like the A417, A1, A303 and A46 are long overdue and will be welcomed in order to tackle congestion.

“When it comes to upgrading motorways, we hope some money will be made available to add more emergency refuge areas on ‘smart’ motorways and that the best stopped vehicle detection systems will be installed as standard on new schemes. Some of the money should also be used to retrofit additional laybys on existing schemes.”

Alex Buttle, director, car selling comparison website Motorway.co.uk, commented: “While £2.5bn to fix Britain’s potholes sounds impressive, it’s a small amount when faced with the enormity of the problem. Many councils are struggling to clear a backlog of potholes that need repairing, and with new potholes popping up every day, it’s an endless task that no amount of money is likely to completely solve forever.”

“UK traffic levels are some of the highest in Europe, and unless more money is invested in public transport to reduce the number of vehicles on our roads, throwing money at fixing holes is simply sticking a plaster on the problem rather than finding a long term fix.”

Road tax

There will be a consultation on plans to change Vehicle Excise Duty (VED, aka road tax) in an effort to link more closely with CO2 emissions. The current system doesn’t make huge sense, as hugely emitting cars only cost more than much greener cars in the first year after registration, after which all equally-priced petrol and diesel cars cost the same in tax, regardless of emissions.

However, Edmund King, president of the AA, warned: “We need to study the detail but it could lead to higher rates of car tax for new and used cars.”

Fuel duty

The tax on fuel has been frozen for more than a decade. This has helped us at the pumps while the price of oil has risen and we’ve had to tighten our personal budgets following the 2008 financial crash, and the ensuing years of austerity.

However, Monday saw the biggest drop in the price of oil for 20 years, with supermarkets cutting the price of petrol and diesel as a result, and some speculated that could present the perfect opportunity for the Chancellor to raise fuel duty. Freezing fuel duty is thought to cost the Treasury around £800m a year and doesn’t fit the government’s ambitions to move drivers from internal combustion engine cars to electric vehicles, as part of plans to meet the UK’s CO2 emissions targets. From 2035 (or possibly 2032), sales of new petrol and diesel models will be banned.

Although today the Chancellor said that he is aware that more must be done to incentivise cleaner forms of transport, fuel duty will be frozen again until at least April 2021.

The RAC’s head of policy Nicholas Lyes said: “We welcome the Chancellor’s freeze in fuel duty which will be a relief to drivers up and down the country. While the Chancellor might have been tempted to increase duty, the reality is that for millions this would have simply increased their everyday driving costs and done nothing to encourage them to switch to cleaner vehicles. And while many want to seek alternative transport options to using their vehicles for some journeys, in so many parts of the country reasonable public transport provision simply does not exist.”

Edmund King, president of the AA, said: “We are pleased the Chancellor has listened to our calls to maintain the freeze in fuel duty. An increase would have had a negative impact on both households and business at a time when the economy is fragile given the current circumstances.”

A radical shake-up of red diesel was also announced. Red diesel is simply diesel fuel taxed at a lower rate than the diesel designated for cars and vans, and aimed at vehicles such as tractors and other agricultural vehicles, road gritters, canal boats and any vehicles that aren’t used on roads. While fuel duty for regular diesel amounts to 58p per litre, for red diesel you only pay 11p per litre in tax, making is much cheaper.

However, the Chancellor said the sections of the economy that use red diesel use some of the most polluting vehicles, emitting 10% of the transport sector’s CO2. The tax relief they get equates to 14m tons of CO2, which Sunak said was the equivalent to the entire populations of London and Manchester taking a return flight to New York. With that in mind he will be abolishing tax relief on some sectors that have been eligible for red diesel from 2022, though he said some industries would retain the benefit, including agriculture, fishing and rail. The Treasury will also “more than double” R&D investment to support the development of alternatives to red diesel, the Chancellor said.

Electric cars and charging infrastructure

Sunak said he wanted to “invest in ideas” by increasing spending on R&D to £22bn a year, including a £900m investment in “nuclear fusion, space and electric vehicles”. This includes electric cars being exempted from premium rate tax (vehicle excise duty, or VED), meaning all pure-electric vehicles — including those costing over £40,000, which are currently subject to a £320 a year charge for five years from the second year after registration — paying zero VED.

In addition, £500m will be made available to support the creation of “new rapid charging hubs” around the country, to make public charging of electric cars away from home easier for owners. Sunak said it would ensure drivers are never more than 30 miles away from being able to charge up their car.

Another surprise is that the Plug-in Car Grant (PiCG), which offers a government discount on the cost of buying a pure-electric car, will continue to 2022-23 after a £403m cash injection. However, it has been reduced by £500 to £3,000 and now excludes electric cars costing £50,000 or more. The PiCG was expected to be scrapped, though, so this will be welcome news to those seeking to incentivise the switch to electric vehicles. In addition, £129.5m has been set aside for the Plug-in Van, Plug-in Taxi and Plug-in Motorcycle grants over the same period.

Electric car drivers will also benefit from changes to the cost of energy, as the Chancellor is “increasing tax on pollution”. From April 2022, he is freezing the levy on electricity while raising it on gas, easing the cost of recharging electric cars (which is already much cheaper per mile than the cost of petrol or diesel).

“The £900m research and development fund which electric cars can draw from is welcome but we would have liked to have seen more immediate investment for gigafactories,” said the AA’s Edmund King. “In order to secure the supply chain of batteries for electric cars a commitment to building these factories would have been a flagship moment.

“Investment of rapid charging points is needed and the Chancellor has recognised this. One of the areas that needs urgent attention is charging where drivers do not have a dedicated off-street parking space, so conversations need to take place with regional electricity boards and local councils to resolve this issue.

“Extending the plug-in grant for another three years (2022-23) was a good move, but the Chancellor could have been bolder to help shift the dial on electric cars. Had he followed our calls the scrap the VAT, it would have had an influential impact on drivers looking to change their car.”

Claire Ega, head of motor at Admiral, said: “We welcome the news in today’s budget that £500million is being invested in rapid charging hubs for electric vehicles. We’ve seen from our own data that interest in electric cars is definitely on the rise. The number of electric vehicles insured with us has increased by 95% on average in the last three years and that’s something we’d expect to grow as consumer focus on the environment intensifies.”

“As it stands, growth in electric vehicle take up isn’t evenly distributed across the country and there are huge discrepancies across the UK, with our data showing that cities in the south are surpassing those in the north. Increasing the funding for charge points is a huge step in evening out the balance of electric vehicles in the UK, and making sure that there is easier access for everyone, regardless of their postcode.”

Seán Kemple, Director of Sales at Close Brothers Motor Finance, commented: “The Chancellor’s pledge to boost investment into zero-emission cars and rapid charging hubs will be pivotal for the motor industry. The UK cannot approach a blanket ban on petrol, diesel and hybrid cars without a network that supports such a seismic transition. Injecting £500m into infrastructure well help settle the concerns of buyers, and support dealers who are overhauling their stock. If the Government sticks to its promises, then demand for alternative fuel vehicles (AFVs) will be boosted and the car market will get the welcome spark it needs.”

Coronavirus impact

Many businesses, including those in the transport sector, will be negatively impacted by the Covid-19 coronavirus outbreak. The Chancellor said that if people fall ill or can’t work, the government would support their finances, and the business that employ them. Statutory sick pay will be paid from day one, not day four, and will also be available for all those who’ve been advised to self-isolate, even if they have not shown any symptoms. Self employed and gig economy workers will be supported by easier access to benefits., and time spent off work due to sickness would be made eaier by removing minimum income floor for Universal Benefit.

There will be a £500,000 boost to benefits, plus a £500,000 hardship fund. Businesses of less than 250 employees will be refunded the costs associated with workers having to take time off for up to 14 days. A new helpline with 2,000 staff has been set up to help those with questions. A new temporary Coronavirus Business Interruption Loan scheme has also been set up, with the government offering a guarantee on bank loans up to a certain amount. In total, £7bn is being committed to support the self-employed, small business and retail.