How to save money on — or even make money from — your car

It pays to think laterally

The past year has seen the price of fuel skyrocket making it increasingly expensive to run a petrol- or diesel-powered car. In recent months, electricity prices have surged, too, making it more costly to run an electric vehicle (though still cheaper than petrol if you charge at home).

That has left many drivers potentially with a money pit sitting in their driveway, and wondering if — as the cost of living crisis bites — they may have to switch to alternative, less convenient and comfortable means of transport for commuting and domestic errands.

Not everybody is able to ditch their car, though, and so it’s good to know that there are a number of ways for motorists not just to save money on their car but to even make some back. Here are some ways in which you can do so.

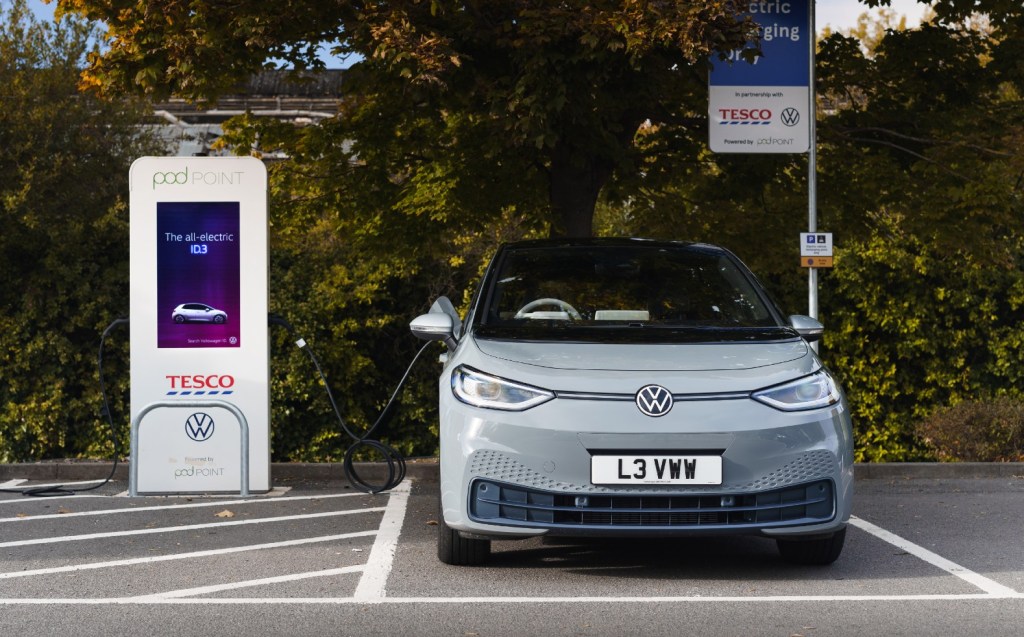

1. Switch to an electric car

The financial savings that can be made from running an electric vehicle are well known — domestic electricity prices are still such that, per mile, EVs are cheaper than petrol and diesel cars to run if you can recharge at home.

What’s more, EV drivers don’t have to pay road tax, London’s Ultra-Low Emissions Charge or Congestion Charges (together equating to £27.50 per day) and the maintenance costs are lower, too.

But private buyers may still find the higher initial cost too much to bear, so it’s important to do some sums before committing.

Business users see much more obvious benefits. Company car drivers benefit from a significant reduction in monthly benefit in kind costs, which means more take-home pay each month.

Companies are switching to electric vehicle fleets because they can benefit from the lower running costs, which are often not passed on to employees, but also because they can claim back 100% of the cost of an electric vehicle against the profits of the year of purchase, with no restriction on the value of the vehicle.

This means that if a business’s corporation profits are lower than the value of the vehicle, deducting the cost of the vehicle may leave the business showing an on-paper loss at the end of the year, which may entitle it to receive tax relief at 19% on the previous year’s profits.

This could potentially mean that a small business (read: small business owner) that buys an electric car for use in connection with the conduct of that business, may be in line to have their accounts backdated by HMRC, which could result in the receipt of a refund of hundreds or thousands of pounds from the tax man.

2. Sign up to a car-sharing club

A huge number of people — especially if they work from home or walk, cycle or use public transport to get to work — don’t need a car from one end of the week to the next. Yet they may still own a car for the weekly shopping trip or to visit friends, for example.

That means that for the vast majority of the time their car is simply sitting outside their house depreciating (reducing in value). And though stationary, it’s still costing hundreds of pounds every year in road tax and insurance.

One way to avoid that cost could be to sell the car and sign up to an on-demand car-sharing scheme such as Zipcar, one of many such companies in operation in the UK that in London also includes Co-wheels, Enterprise Car Club and Ubeeqo.

The idea is that with a monthly subscription (although Zipcar’s most basic plan is actually free apart from the sign-up charge), members can hire a car by the hour or day.

On Zipcar’s mid-tier “Smart” price plan, for instance, hiring a medium-sized car costs £8 per hour with an allowance of 60 miles per day with all fuel, road tax, insurance and, if in London, the Congestion Charge paid for by Zipcar.

3. Hire a private owner’s car nearby — or rent out your own car

Other car-sharing companies can allow you to rent private owners’ vehicles nearby, or make your own car available for hire.

Firms such as Hiyacar and Getaround use peer-to-peer car-sharing to allow people to borrow local cars that are otherwise unused most of the time.

Hiyacar claims car owners could earn up to £650 per month by renting out their vehicle, though even if it results in a much small income it could be enough to cover your insurance and tax. Other benefits of renting out your car include AA Breakdown Cover and discounted services at KwikFit.

4. Rent out your driveway or parking space

If you’re in the enviable position of having a parking space or empty driveway in an area where parking is at a premium, you could be missing out on a nice little earner.

By renting out your driveway or parking space through an app or website such as YourParkingSpace or JustPark you can make up to £1,000 per year tax-free. If you go beyond that threshold you’ll need to fill out a tax return, but it still might be worth your while.

Residents who live near places such as major hospitals, airports and train stations are at a particular advantage when it comes to renting out their driveways, as they’ll often have a steady and willing stream of workers or commuters who’d rather rent a relatively safe driveway space for the day than battle to find a parking spot elsewhere.

5. Borrow your friend or neighbour’s car

An alternative to companies such as Zipcar is to borrow the car of a friend or family member when they’re not using it.

You’ll still need to be insured to drive their car, of course, but don’t be put off as you can take out temporary short-term car insurance as and when you need it.

Many companies in the UK including Cuvva, Veygo by Admiral, the RAC, GoShorty and Aviva provide temporary car insurance that allows drivers to drive another person’s car for short periods and can be taken out by the hour, day or week.

Most have a very simple-to-use app or website and arranging hourly insurance can be a matter of a few minutes.

One further benefit of this is that you’re fully insured to drive another person’s car but don’t need to worry about affecting their no-claims bonus if you have an accident.

6. Advertise on your car

This is one at which many may baulk on the grounds of taste more than anything, but drivers could potentially make as much as £100-£150 per month by allowing their car to be used as an advertising billboard.

There are a number of companies operating this type of business in the UK, but the best-known are Car Quids and Drovo, which connect car owners with potential advertisers.

Obviously a rusty old banger that stays parked in a suburban driveway all day won’t garner much interest from advertisers, but if you drive a newish car (preferably higher-end and newer than 2009), it looks reasonably smart and you drive or park in high-traffic areas where the car can easily be seen during the day, a company such as Car Quids or Drovo is more likely to be able to connect you with an advertiser who wants to have their branding professionally applied to your bonnet or doors.

Before rushing headlong into renting your car out as advertising space though, it’s worth checking with your insurer, as for some it may constitute a change of use or a modification to the car.

7. Reduce your fuel consumption

Even if you’re not in a position to abandon your car or go electric, there are still ways to cut down on your fuel consumption and running costs by thinking about how you drive.

Driving.co.uk has written extensively on the topic, but the main pointers on how to cut the amount of fuel you use are:

- Make sure your tyres are inflated to the correct pressure.

- Keep your car serviced and well-maintained, changing oil and filters regularly.

- Reduce the amount of unnecessary weight carried in the car.

- Remove roof racks or roof boxes when not in use.

- Especially on motorways, reducing your average speed by 10mph can make a difference.

- Drive in as high a gear as possible without letting the engine labour.

- Conserve momentum by reading the road ahead and reducing braking and acceleration.

- Avoid using the air conditioning when it’s not needed.

N.b. We may receive a small commission fee if you click on a link to an external website and purchase a product as a result, but these links are designed to make your life easier and it does not affect our editorial independence.

Related articles

- After reading our tips to save money on or make money from your car, you may like to check out this list of things to know before you buy your first EV

- You might also be interested in our roundup of five of the best city cars

- Visit Driving.co.uk’s car clinic here

Latest articles

- Skoda Kodiaq 2024 review: All new but business as usual for brilliant seven-seat SUV

- Dodging firebombs in the BMW i7 Protection: An electric limo that can protect you from big bullets and small explosives

- European court calls for car fuel economy test to be replaced after studies find large over-estimations

- McLaren P1 designer releases images of space capsule for tourists

- Alfa Romeo Milano, Italian brand’s first electric car, breaks cover

- Porsche Taycan 2024 review: The sublime and the ridiculous

- New BMW-powered Morgan Plus Four released, keeps classic shape

- Etiquette authority Debrett’s now has official advice for electric car drivers

- New Audi S3 gets more power and borrows parts from the RS 3