Without a tax disc, how can I check that my vehicle is still taxed?

Will I get a reminder?

ACCORDING to the Department for Transport (DfT), the number of untaxed cars on UK roads has more than doubled since the tax disc was abolished last year.

Click to read car REVIEWS or search NEW or USED cars for sale on driving.co.uk

DfT figures show there were 210,000 untaxed motors in 2013 but since the disc became history on October 1, 2014, that figure has shot up to 560,000. While the Treasury was losing out to the tune of £35m a year, it’s now down by an estimated £80m – yet ditching the costs associated with producing paper tax discs was predicted to save just £10m annually.

More drivers aren’t deliberately tax-dodging, says the DfT, rather it take a while for them to get used to the changes.

Without a paper tax disc as a reminder, how do drivers know when to renew their vehicle tax?

- The DVLA still writes to drivers to tell them when their tax needs to be renewed — the reminder should come through the post three to four weeks before action needs to be taken

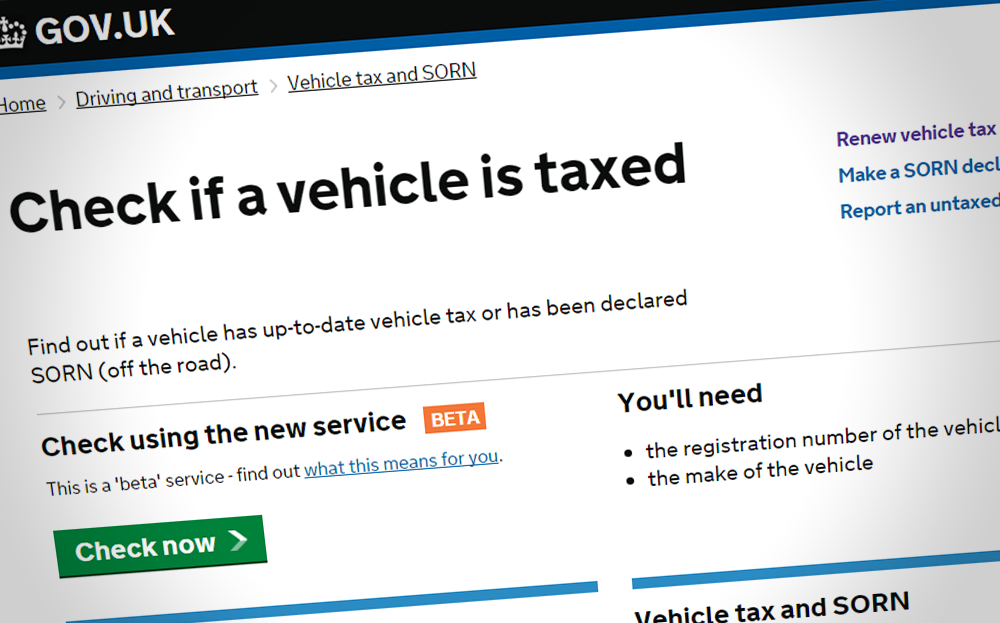

- Drivers can check online at www.gov.uk/check-vehicle-tax

How do I tax my car?

Your tax reminder from the DVLA will tell you how much you need to pay, with a choice of paying for six or 12 months (tax-free classic cars automatically get the latter option).

Once your reminder comes through you need to make sure your car is insured and MoTed. If it isn’t, you can’t tax your car.

You can renew your tax in one of three ways:

- Go to a Post Office

- Do it over the phone (0300 123 4321)

- Set everything up on the DfT website

You’ll need a method of payment for your vehicle tax and

- Your vehicle tax reminder letter (V11) or

- A V5C registration certificate (log book) in your name or

- A new keeper supplement (V5C/2), if you’ve just bought the vehicle

You may also need:

- Your MOT test certificate (must be valid when the tax starts)

- A valid reduced pollution certificate

In Northern Ireland you’ll also need an insurance certificate or cover note.

How much does it cost?

How much you pay depends on the age of your car and either its engine size or its CO2 emissions.

- If your car was built (if not necessarily registered) before January 1, 1976, it’s free to tax.

- If your car was registered before March 1, 2001 you’ll pay £145 to tax it for a year if its engine is no bigger than 1549cc. A larger engine means it’s £230 per year.

- If your car was registered on or after March 1, 2001 the amount of road tax you pay is dependent on its CO2 emissions. There are 11 bands priced between nothing (for cars emitting under 100g/km) and £290 (for cars rated at over 201g/km).

- Cars registered after March 23, 2006 are split into 13 bands, priced between nothing and £505 (sub-100g/km and over 255g/km respectively). See the table below for details.

- In April 2017 a new system is set to be introduced, in which everyone pays £140 per year. Anything rated at 0g/km of CO2 will be exempt (so just pure electric cars), while you’ll have to pay a £310 charge for the first five years if your car had a list price of £40,000 or more when it was sold new.Read also:

Click to read car REVIEWS or search NEW or USED cars for sale on driving.co.uk

| New cars | Petrol car (tax class 48) and diesel car (tax class 49) |

Alternative fuel car (tax class 59) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| First year rate | Standard rate | First year rate | Standard rate | ||||||

| Bands | CO2 emission figure (g/km) * |

12 months | 6 months | 12 months | 6 months | 12 months | 6 months | 12 months | 6 months |

| A | Up to 100 | £0.00 | £0.00 | £0.00 | £0.00 | ||||

| B | 101 – 110 | £0.00 | £20.00 | £0.00 | £10.00 | ||||

| C | 111 – 120 | £0.00 | £30.00 | £0.00 | £20.00 | ||||

| D | 121 – 130 | £0.00 | £110.00 | £60.50 | £0.00 | £100.00 | £55.00 | ||

| E | 131 – 140 | £130.00 | £71.50 | £130.00 | £71.50 | £120.00 | £66.00 | £120.00 | £66.00 |

| F | 141 – 150 | £145.00 | £79.75 | £145.00 | £79.75 | £135.00 | £74.25 | £135.00 | £74.25 |

| G | 151 – 165 | £180.00 | £99.00 | £180.00 | £99.00 | £170.00 | £93.50 | £170.00 | £93.50 |

| H | 166 – 175 | £295.00 | £205.00 | £112.75 | £285.00 | £195.00 | £107.25 | ||

| I | 176 – 185 | £350.00 | £225.00 | £123.75 | £340.00 | £215.00 | £118.25 | ||

| J | 186 – 200 | £490.00 | £265.00 | £145.75 | £480.00 | £255.00 | £140.25 | ||

| K | 201 – 225 | £640.00 | £290.00 | £159.50 | £630.00 | £280.00 | £154.00 | ||

| L | 226 – 255 | £870.00 | £490.00 | £269.50 | £860.00 | £480.00 | £264.00 | ||

| M | Over 255 | £1100.00 | £505.00 | £277.75 | £1090.00 | £495.00 | £272.25 | ||

* g/km = grammes of CO2 produced with each kilometre travelled